It is possible that depictions of violence often glamorize vicious behavior. They offend the Spirit and could possibly make one less able to respond to others in a sensitive, caring way. They also may contradict the Savior’s message of love for one another. The second portion of our interviews with carjackers dealt with the aftermath of carjackings. Here, we are concerned with basic questions: What did they do with the vehicles? What did they do with their money? Given the propensity of many carjackers to target other offenders, how did they mange the threat of retaliation? The majority of our respondents immediately disposed of the vehicle, liquidating it for cash. As Corleone put it, “there’s a possibility they report[ed] the car stolen and while I’m driving around the police [could] pull me over. I ain’t got time to hop out [of the vehicle] and run with no gun. I just want to get the money that I wanted.” Although most of our respondents immediately delivered the vehicle to a chop shop or dismantled it themselves, a fair number of them chose to drive the vehicle around first, showing it off or “flossing” to other neighborhood residents and associates. Despite the possibility that the vehicle’s owner or the police might catch up with them, they chose to floss. INT: “What do you like to do after a carjacking?” Binge: “Well, what I like to do is just like to, see my friends. They don’t give a damn either, I just go pick them up and ride around, smoke a little bit [of] weed, and get some gals, and to partying or something like that you know. I know it’s taking a chance but, you know like I say, they don’t give a damn. #RandolphHarris 1 of 21

INT: “Is that what you did with the car that you took off the guy at the Lightrail?” Binge: “Yeah. I was just riding around listening to the music, picked up a couple of friend of mine. We rode around. I told them it was a stolen car. It was a nice little car too. Black with a hard top. Oh yeah, oh yeah—[it had] nice sounds. I was chilling man, I was chilling, you know? I was driving along with the music playing up loud. Ha ha. You know I wasn’t even worried. I was just feeling good. ‘Cause I’m not used to driving along with music playing up loud. Ha ha. You know I wasn’t even worried. I was just feeling good. ‘Cause I’m not used to driving that much you know ‘cause I don’t have a car you know. That’s why when I do a carjacking I just play it off to the tee, run all the gas off, keep the sounds up as loud as I can, keep the heat on, you know just abuse the car you know. That’s all about carjacking like that.” C-Low described his desire to floss as having to do with the ability to gain status in his neighborhood. C-Low: “Put it this way, you got people you know that’s driving around. We just wanna know how it feels. We’re young and we ain’t doing sh*t else. So they [people from the neighbourhood] see you driving the car, they gonna say, “Hey, there’s C-Low!” and such and such. That makes us feel good ‘cause we’re riding, and then when we’re done riding we wreck the car or give it to somebody else and let him ride. We took the car and drove around the hood, flossing everything. And then we wrecked it on purpose We ran it into a ditch. I don’t know, we were f*cked up high, we were high man, just wild! Wrecked the thing.” #RandolphHarris 2 of 21

However, for offenders like these, the prospect of getting caught and losing profits eventually began to outweigh the benefits of showing off. INT: “So how long did you drive around in the [Chevrolet] Suburban before you stripped it?” LOCO: “Oh, we was rolling that. We drove for a good thirty minutes, then I said that I want[ed] to get up out of it because they might report it stolen. We was [still driving] right there [near] the scene [of the crime] and they [the police] would probably tried to flag me [pull me over]. And if they tried to flag me, I would [have to] have taken them through a high-speed chase. F*ck that.” Sleezee-E informed us (as did other respondents) that disposing of the vehicle quickly was the key to getting away with a carjacking. Indeed, almost all respondents were aware of the police department’s “hot sheet” for stolen vehicles (although their estimations of how long it took for a vehicle to show up on the hot-sheet varied greatly, from as soon as the vehicle was reported stolen to 24 hours or even longer afterwards). Sleezee-E: [People think that] the cops will wait 24 hours just to see what you are going to do with the car. Because some idiots, when they jack a car, they just drive it around and then they leave it someplace. I don’t do that. That’s how you get caught. Driving it around. You take that car right to the chop shop and let them cut that sucker up.” Once the vehicle was stripped, most carjackers disposed of the vehicle by destroying it somehow. #RandolphHarris 3 of 21

Littlerag: “’Cause it was hot man! It was too hot. All I [wanted] was to take the rims, take the beats, the equalizer, the detachable face. Got all that off, then I just pour gas on it and burnt that mother*cker up. I had finger prints [on it]. I didn’t have no gloves on. I had my own hands on the steering wheel. I left my fingerprints.” Nicole and a boyfriend chose a less conventional method of getting rid of their stolen vehicle. Nicole: We got rid of the car first. We drove the car two blocks and went back down a ways to the park. We drove the car up there, we parked right there and sat for about ten minutes, made sure how many cars come down this street before we can push it over there. It’s a pond, like it’s a lake out there with ducks and geeses in it.” While a few respondents reported that they used the proceeds from carjacking to pay for necessities or bills, the overwhelming majority indicated that they blew their cash indiscriminately on drugs, women, and gambling. We had interviewed Tone on a number of previous occasions for his involvement in strong-arm drug robbery. Although robbery was his preferred crime, he engaged in carjacking occasionally (about once every two months) when easy opportunities presented themselves. During his most recent offense, he and three of his associates took a Cadillac from a neighborhood drug dealer and made $6000. When we asked what he did with his portion, he indicated that he, “…spent that sh*t in like, two days.” #RandolphHarris 4 of 21

INT: “You can go through $1500 in two days?” Tone: “Sh*t, it probably wasn’t even two days, it probably was a day, sh*t.” INT: “What did you spend fifteen hundred on?” Tone: “It ain’t shit that you really want. Just got the money to blow so f*ck it, blow it. Whatever, it don’t even matter. Whatever you see you get, f*ck it. Spend that shit. It wasn’t yours from the getty-up, you know what I’m saying? You didn’t have it from the jump so…Can’t act like you careful with it, it wasn’t yours to care for. Easy come, easy go. The easy it came, it go even easier. F*ck that, f*ck all that. I ain’t trying to think about keeping nothing. You can get it again. INT: “So what does money mean to you? Tone: “What money mean? Sh*t, money just some sh*t everybody need, that’s all. I mean, it ain’t jack sh*t.” INT: “Ok, so it’s not really important to you? Tone: “F*ck no. Cause I told you, easy come, easy go.” Mo had taken a Mercedes-Benz from two men residing in another neighborhood. He had planned the offense over the course of a month and finally, posing as a street window cleaner, carjacked them as they exited a local restaurant. The vehicle’s after-market items netted $5000 in cash. INT: “I’m just kind of curious how you sped like $5,000!” MO: “Just get high, get high. I just blow money. Money is not something that is going to achieve for nobody, you know what I’m saying? So everyday, there’s not a promise that there’ll be another [day] so I just spend it, you know what I’m saying? It ain’t mine, you know what I’m saying, I just got it, it’s just in my possession. This is mine now, so I’m gonna do what I’ve got to do. It’s a lot of fun. At a job you’ve got to work a lot for it, you know what I’m saying? You got to punch the clock, do what somebody else tells you. I ain’t got time for that. Oh yeah, there ain’t nothing like gettin’ high on $5000!” #RandolphHarris 5 of 21

Binge and others confirmed that the proceeds from their illegal activities went to support this form of conspicuous consumption. Binge: “I just blowed it man. With the money me and my girlfriend went and did a bit of shopping, stuff for Christmas. But, the money I got from his wallet? I just blowed that, drinking and smoking marijuana.” For Corleone, the motivation to carjack was directly related to his desire to manage the impressions of others in his social milieu. His remarks served as a poignant comment on sociocultural and peer pressures experienced by many inner city youths. The purpose of carjacking was to obtain the money he needed to purchase clothing and items that would improve his stature in the neighborhood. Corlone: “[$1500 is] a lot. [I bought] shoes, shoes, everything you need. Guys be styling around our neighborhood. The brand you wear, shoes cost $150 in my size. Air Jordans, everybody want those. Everybody have them. I see everybody wearing those in the neighborhood. I mean come on, let’s go get a car. I’m getting those, too.” INT: “How man pairs of sneakers have you got?” Corleone: “Millions. I got, I got, I got a lot of shoes. Clothes, gotta get jackers. INT: “Well, why do you have to look good, what’s so big about looking good?” Corleone: “You can’t. Not nowadays, not where I’m from. You try to walk up to a girl, boy, you got on some raggedy tore up, cut up shoes they’re gonna spit on you or something. Look at you like you crazy. Let’s say you walking with me. I got on creased up pants, nice shoes, nice shirt and you looking like a bum. Got on old jeans. And that dude, that dude, he clean as a mother*cker and you look like a bum.” #RandolphHarris 6 of 21

INT: “So you’re competing with each other, too?” Corleone: “Something like that. Something like a popularity contest.” INT: “Well, you know, you can look nice and clean and not have to spend $150 bucks on shoes, you know.” Corleone: “It’s just this thing. You aint’ going [to] understand, you don’t come from the projects.” In the extraordinary onslaught of the deceiver which will come upon the whole of Christendom at the close of the age, through his army of deceiving spirits, there are some, more than others, who will for a particular reason be attacked by the powers of darkness. These individuals need clear light as to his deceptive workings, so that they may pass through the trial of the “last hour” and be counted worthy to escape that hour of greater trial which is coming upon the Earth (Luke 21.34-36; Rev. 3.10). These are the ones who are recklessly ready to follow the Lord at any cost, and yet do not realize their unpreparedness for the contest with the spiritual powers of the unseen World as they press on into fuller spiritual things. They are believers who are full of mental conceptions wrought into them in earlier years—views and opinions which hinger the Spirit of God from preparing them for all they will meet as they press on to their coveted goal, and which also hinder others from giving them from the Scriptures much that they need to know regarding the spiritual World into which they are so blindly advancing. These sentiments lull them into a false security, and give ground for, and even help bring about, that very deception which enables the deceiver to find them as easy prey. #RandolphHarris 7 of 21

Being spiritual prey can make one feel that family companionship and activities can be a little nerve-racking, and they may want to get away from the constant harping. Some may even think other groups look appealing, until they join them and find out they have nothing in common. While these individuals sit alone, they may feel isolated, yet content. After being involved in an accident and being in a hospital, one may feel aloneness and emptiness. They may not be terrified because one understands why things are done; but one still feels the pain, and no one is able to share it with the individual. It is a very personal experience. Many people are connected with their childhood because they still live in a World of fantasy. Anytime during the day or night when one is not actively thinking or doing something specific, one may have dreams of something they like or admire. Sometimes these fantasies have something to do with the lack of “participant” love that one has felt all of one’s life. They know they are loved by their families, but I think that want non-familial relationships. Yes let there be loneliness, for where there is loneliness, there also is love, and where there is suffering, there also is joy. If faith strike a chord so deep in human nature, the question can be posed: Is faith universal? There are two forms of faith: the formal and the material. The formal definition of faith is valid for every kind of faith in all religions and cultures. Faith, formally or generally defined, is the state of being grasped by that toward which self-transcendence aspires, the ultimate in being and meaning. #RandolphHarris 8 of 21

This formal or universal definition of faith is particularized in the material definition of faith which is the Christian faith, the state of being grasped by the New Being as it is manifest in Jesus as the Christ. Whatever is said of formal faith applies to material faith, although the reverse is not true, because material faith contributes a specification not found in formal faith. It suffices for the present to say that we reconcile the two definitions by holding that Christianity, as the particular (material) definition of faith, expresses the fulfilment toward which all forms of faith are driven. The note of universality enters through the formal definition of faith, for in this formal sense of faith as ultimate concern, every human being has faith. Every human spirit drives toward the unconditional in the direction of self-transcendence. One who is not able to perceive something ultimate, something infinitely significant, is not a man Faith is a universal human potentiality because the human heart is aware that it is ordered to the infinite, but is not yet in possession of it. The seeds of faith are sown in the restlessness of man’s spirit, his striving to transcend the stream of transitory, preliminary concerns in which one is submerged. Thus, the state of being ultimately concerned is a state which is universally human, whatever the content of the concern may be. Of course, the content of ultimate concern can be demonically distorted so that faith becomes idolatrous faith, but it remains faith despite this ambiguity. Our ultimate concern can destroy us as it can heal us, but we never can be without it. #RandolphHarris 9 of 21

Faith in Capitalism is also important to some people. However, things that work well for Western companies to be able to survive in the global market, pose big problems for Western economies as a whole, narrowing their domestic manufacturing base and worsening the employment environment. No easy solutions are in sight. However, these problems can and should be tackled more actively at the national policy level. What can be done? To begin with, the West has to accept that trying to keep its ailing industries afloat by pressing China to appreciate the yuan will not provide a genuine solution. (Though it does not mean that the West should not press China to appreciate yuan—it should, but for a different reason; we will come back to this point later on.) Protectionist measures like punitive import tariffs are an even worse option. Doing effectively nothing to protect industries, they create risks of trade wars, harm consumers, and send the wrong signals to domestic producers: wrong because today it is basically more efficient to produce mass products in China than in the West. Two closely interrelated strategies are vital to address the challenges posed by China’s export offensive. First, Western governments have to do more to encourage differentiation and upgrading of products by domestic factories (in other words, to help them shift from segments one and two to segments three and four) in order to expand the cohort of domestic manufacturers, especially SME, with high non-price competitiveness. The task of primary importance is to promote exports of such upgraded and differentiated products, especially to China and other emerging countries. #RandolphHarris 10 of 21

If an active export promotion policy is not in place, market constraints can critically weaken companies’ motivation to differentiate and upgrade and, as a result, erode the technological base the West has already created, threatening its command over core manufacturing technologies. Here is a quote from a conference address by Haruhisa Gai, the president of Tsubamex, a well-known Japanese manufacturer of mold models and the first company in the industry that introduced a three dimensional CAD-CAM system to speed up product development and raise its quality. The topic under discussion was globalization and challenges from Chinese and other companies from the emerging World. Mr. Gai said: “Costs aside, today there are only two countries in the World that can make any kind of a prototype: Japan and America. Even Germany cannot produce certain customized models. The levels of Japan’s manufacturing technologies is very high, but these says there is no work—and makers do not introduce new machines. If there are no new machines, no new technologies will be born. It is a very big problem…One of our major headaches is that even if we get orders it is uncertain whether we will get the payment in due course—especially from overseas. It is very difficult to collect the money we have to be paid. It would be nice if this can be done by the state…We count a lot on our link with overseas, but there are a lot of obstacles.” The fragment quoted brilliantly articulates the problem and expresses concerns existing in Japan’s business community. #RandolphHarris 11 of 21

To address the Chinese challenge, Western governments have to orchestrate a large-scale export counteroffensive on the Chinese market. In broader terms, they have to come out with a wide-range export promotion policy, centered on those domestic small and medium-size producers that are really capable of differentiating their products and climbing up the value chain. The promotion package can include far more active assistance in market research and sales promotion, in the establishment of overseas distribution industry people. Stage advertising campaigns. Do not be shy about allocating sufficient budget funds for these purposes. And, of course, do all you can to make China reduce its tariff and nontariff import barriers. Much more can be done at the local administration level. Establish and expand direct province-to-province and city-to-city relations. (How many America and European cities have sister relations with Chinese cities? Not too many, really.) Organize various public events, and let the Chinese audiences know how good and attractive the products from your homeland are. They will be interested, without any doubt. Establish trade representative offices—and not only in Beijing and Shanghai, but also in other Chinese cities, effectively acting as export agent for your homeland’s producers and their associations. #RandolphHarris 12 of 21

Studying the feasibility of the U.S.A.-China and the EU-China free trade agreements would be a great idea. Can American and European leaders show enough vigor and courage to come out with such strategic initiatives? (Japan and South Korea are already working with China on a trilateral FTA, and the process seems to be gaining momentum.) It may not be as simple as endless debates about currency manipulators, but it is worthy trying. The range of options is wide. Without drastic steps of this kind, the West’s deficits in its trade with China will continue to increase, and more and more Western manufacturers will have to being down the curtain. The new system for making wealth consists of an expanding global network of markets, banks, production centers, and laboratories in instant communication with one another, constantly exchanging huge—and ever-increasing—flows of data, information, and knowledge. This is the “fast” economy of tomorrow. It is this accelerative, dynamic new wealth-machine that is the source of economic advance. As such, it is the source of great power as well. To be de-coupled from it is to be excluded from the future. Yet that is the fate facing many of today’s “LCDs,” or “less developed countries.” As the World’s main system for producing wealth revs up, countries that wish to sell will have to operate at the pace of those in a position to buy. This means that slow economies will have to speed up their neural responses, lose contracts and investments, or drop out of the race entirely. #RandolphHarris 13 of 21

The earliest signs of this are already detectable. The United States of America in 1980s spent $125 billion a year on clothing. Half of that came from inexpensive-labor factories dotted around the World from Haiti to Hong Kong. Tomorrow much of this work will return to the United States of America. The reason is speed. Of course, shifting taxes, tariffs, currency ratios, and other factors still influence businesses when overseas investment or purchasing decisions are made. However, far more fundamental in the long run are changes in the structure of cost. These changes, part of the transition to the new wealth-creation system, are already sending runaway factories and contracts home again to the United States of America, Japan, and Europe. The Tandy Corporation, a major manufacturer and retailer of electronic products, not long ago brought its Tandy Color Computer production back from South Korea to Texas. While the Asian plant was automated, the Texas plant operated on an “absolutely continuous” flow basis and had more sophisticated test equipment. In Virginia, Tandy set up a no-human-hands automated plant to turn out five thousand speaker enclosures a day. These supply Japanese manufacturers, who previously had them made with low-cost labor in the Caribbean. The computer industry is, of course, extremely fast-paced. However, even in a slower industry, the Arrow Company, one of the biggest U.S.A. shirtmakers, transferred 20 percent of it dress-shirt production back to the United States of America after fifteen years of off-shore sourcing. #RandolphHarris 14 of 21

Frederick Atkins Inc., a buyer for U.S.A. department stores, has increased domestic purchases from 5 percent to 40 percent in three year. These shifts can be traced, at least in part, to the rising importance of time in economies. The new technology is giving domestic apparel makers an important advantage over their Asian competitors. Because of fickle fashion trends and the practice of changing styles as often as six times a year, retailers want to be able to keep inventories low. This calls for quick response from apparel makers that can offer fast turnaround on smaller lots in all styles, sizes and colors. Asian suppliers, half a World away, typically require order three months in advance. By contrast, Italy’s Benetton Group delivers midseason reorders within two to three weeks. Because of its electronic network, Haggar Apparel in Dallas is now able to restock its 2,500 customers with slacks every three days, instead of the seven weeks it once needed. Compare this with the situation facing manufacturers in China who happened to need steel. In 1988, China suffered the worst steel shortages in memory. Yet with fabricators crying out for supplies, 40 percent of the country’s total annul output remained padlocked in the warehouses of the Storage and Transportation General Corporation (STGC). Why? Because this enterprise—incredible as it may seem to the citizens of fast economies—makes deliveries only twice a year. #RandolphHarris 15 of 21

The fact that steel prices were skyrocketing, that the shortages were creating a black market, that fraud was widespread, and that companies needing the steel faced crisis meant nothing to the managers of STGC. The organization was simply not geared to making more frequent deliveries. While this is no doubt an extreme example, it is not isolated. A “great wall” separates the fast from the slow, and that wall is rising higher with each passing day. It is this cultural and technological great wall that explains, in part, the high rate of failures in joint projects between fast and slow countries. Many deals collapse when a slow-country supplier fails to meet promised deadlines. The different pace of economic life in the two Worlds make for cross-cultural static. Officials in the slow country typically do not appreciate how important time is to the partner from the fast country—or why it matters so much. Demands for speed seem unreasonable, arrogant. Yet for the fast-country partner, nothing is more important. Delivery delayed is almost as bad as delivery denied. The increasing cost of unreliability, of endless negotiation, of inadequate tracking and monitoring, and of late responses to the demands for up-to-instant information further diminish the competitive edge of low-wage muscle work in the slow economies. So do expenses arising from delays, lags, irregularities, bureaucratic stalling, and slow decision-making—not to mention the corrupt payments often required to speed things up. #RandolphHarris 16 of 21

In the advanced economies the speed of decision is becoming a critical consideration. Some executives refer to the inventory of “decisions in process,” or “DIP,” as an important cost, similar to “work in progress.” They are trying to replace sequential decision-making with “parallel processing,” which breaks with bureaucracy. They speak of “speed to market,” “quick response,” fast cycle time,” and “time-based competition.” The increase precision of timing required by systems like “just-in-time delivery” mean that the seller must meet far more rigid and restrictive schedule requirements than before, so that it is easier than every to slip up. In turn, as buyers demand more frequent and timely deliveries from overseas, the slow-country suppliers are compelled to maintain larger inventories or buffer stocks at their own expense—with the risk that the stored parts will rapidly become obsolete or unsalable. The new economic imperative is clear: Overseas suppliers from developing countries will either advance their own technologies to meet the World speed standards, or they will be brutally cut off from their markets—casualties of the acceleration effect. Manager generally take a rosy view of time: markets expand, better technologies become available, information improves. However, where there is growth, there is also decay. More than 10 percent of the United States of Americas’ manufacturing output was accounted for by industries whose real output had shrunk during the 1970s. #RandolphHarris 17 of 21

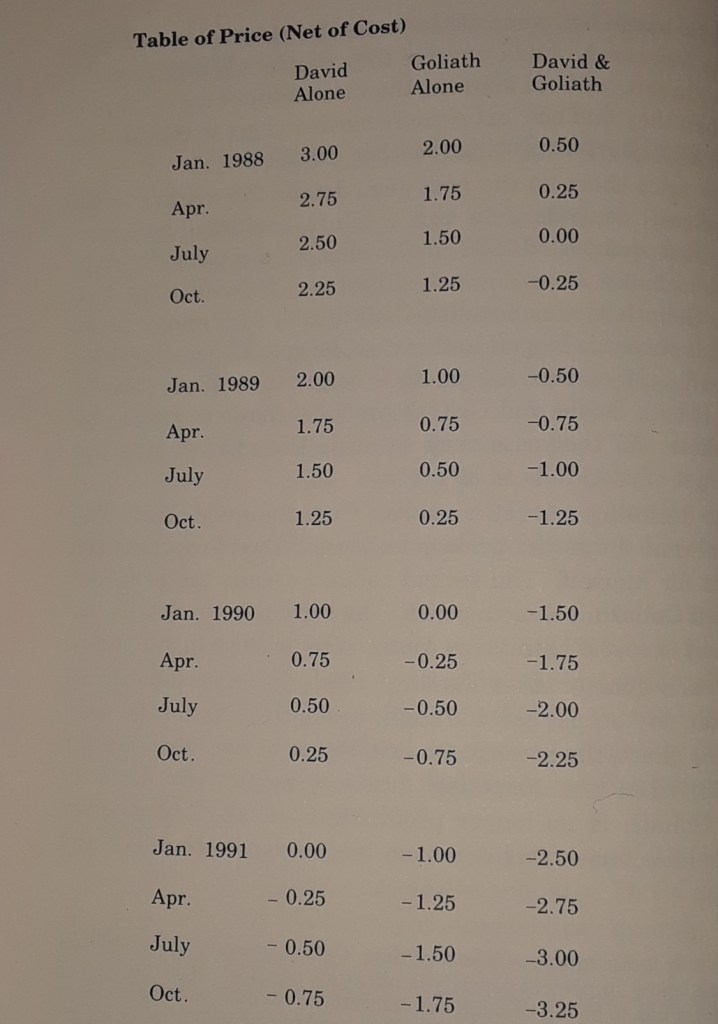

These declining industries range from core manufacturing such as steel, tire, and rubber to fibers and chemicals, to aby foods and vacuum tubes. The reasons for the decline are varied, ranging from technological progress (transistors over vacuum tubes) to improved foreign competition (steel) to regulation (chemicals) to changing demographics (baby foods). In these declining industries, someone must reduce capacity in order for the industry to remain profitable. Each firm would like its competitors to shoulder the reduction; that way they can capture the remaining market by themselves This case examines the questions of whether survivability is related to size. In declining markets, do Davids cut Goliaths down to size or do they get stepped on? David is a small producer. He manufactures one slingshot per quarter. Goliath is twice David’s size. He produces two slingshots per quarter. The two competitors have no flexibility in choosing output. If they are in, they are in; once they stop, they cannot come back. Their battle has some of the same characteristics as Time versus Newsweek. Each quarter they decide whether to produce or to exit, without knowing their competitor’s coeval choice. However, then they find out last period’s move and get to repeat the battle next quarter (provided neither exited). Starting in the first quarter of 1988, if David is a monopolist, he can expect to make $3 on his one slingshot. #RandolphHarris 18 of 21

If David exists and leaves Goliath as a monopolist, Goliath gets a lower unit price since his output is bigger; in the case, he gets $2 per slingshot. (Of course, $2 on two slingshots is better than $3 on David’s one.) If both David and Goliath produce, they are said to be duopolists. In that cause they saturate the market, and the prince (net of cost) falls to 50 cents. The declining market is evident from the price chart. The first column shows the price net of cost if David captures the market for himself. The second column details the price net of cost if Goliath is a monopolist. The third column details the price net of cost if both firms continue to produce in a duopoly. In each quarter after January 1988, the price falls by 25 cents for any output level brough to market. As can be seen from the cart, the pressure to exist begins in the third quarter of 1988, when the duopolists first lost money. By January 1990, Goliath is no longer profitable even as a monopolist. A year later, even David can no longer expect to make any money. Over the twelve quarters from 1988 to 1991 the slingshot industry will become extinct. But when do the firms exit? Who gives up first? When do they exit? This problem can be solved using the technique of sequentially eliminating dominated strategies. To get you started, note that staying past January 1990 is a dominated strategy for Goliath, as he forevermore loses money, irrespective of whether David stays or exists. #RandolphHarris 19 of 21

Now work backward and ask what you would do if you were David and it was the third quarter of 1989 and Goliath was still producing. (In calculating the value of the worst-case scenario, you can simplify the mathematics by assuming a zero interest rate; profits (losses) tomorrow and today are equally valuable.) In this problem, it does not matter how much money you make, just how long you can make it. The firm that can hang on the longest can force out its more profitable rival as soon as duploy profits begin to turn negative. As suggested in the hint, if David can hold on until the third quarter of 1989 he is home free. From then on, the worst possibility is that Goliath stays in the market through the fourth quarter of 1989. This will cost David $2.25in duoploly losses. However, when 1990 comes, Goliath must exit, since he suffers losses either as a duopolist or as a monopolists. Thus, David can count on making $2.50 in monopoly profits during the 1990s, which is enough to tide him over any possible losses during the final two quarters of 1989. Now, the power of backward reasoning picks up steam. Given that David is committed to staying upon reaching July 1989 (exiting is a dominated strategy), Goliath can expect to earn only losses from July 1989 onward. Thus, he will exit immediately if he ever finds himself as a duopolist on that date. That means that David can expect to make the $2.50 as a monopolist in 1990 and $2.75 as a monopolist in the final two quarters of 1989. This windfall of $5.25 more covers the maximum duopoly losses up until that date ($1.50), and therefore David should never exit before January 1991. Given that David is committed to staying, Goliath should leave as soon as duopoly profits turn negative, July 1988. Note that Goliath cannot make the same commitment to stay in the market for the same length of time. #RandolphHarris 20 of 21

That commitment breaks down first in January 1990, and then the guarantee exist by January 1990 translates into a forced exit by July 1989. The slippery slope for Goliath brings him back to October 1988, the first instance when the market is not big enough for the two of them. This simple story of fighting for a market share in declining industries may help explain the observation that large firms are often first to exit. Charles Baden Fuller, an expert in the decline of British markets, reports that when the demand for U.K. steel casing fell by 42 percent over the period of 1975—1981, executives of the two largest firms, F. H. Lloyd and the Weir Group, “felt that they had borne the brunt of the costs of rationalization; they accounted for 41 percent of the industry output in 1975, but for 63 percent of the capacity that was withdrawn over the 1975-1981 period, reducing their combined market share to 24 percent. Remember that size is not always an advantage: in judo and here in exit strategies, the trick is to use your rival’s bigger size and consequently inflexibility against him or her. This strategy can be applied to China. A big battle for the Chinese market is starting. In 2009, China became not only the World’s top exporter, but also the second-largest importer. It is the number one market for an increasing amount of both capital and consumer goods. For instance, its share of the World market optical fibers has been the largest producers in the World with a 62 percent share of the global total in 2022. According to the study, shipments from machine tool plant in China accounted for a whopping 30 percent of the $92.7 billion total produced by 28 countries around the globe, and China manufactures 36 percent of the World’s electronics. In addition, with nearly one-fifth of the World’s population, China is the second-largest final consumption market—after the U.S.A.—for electronic devices embedded with semiconductors. It is the largest market for cars and brand fashion goods and is about to become the number one for luxury goods. The list can be continued. Yet, the competition for tapping this market is becoming increasingly fierce, and more often than not Western companies appear to be not on the winning side. #RandolphHarris 21 of 21

With accents of elegance, spacious living areas, and convenient workspaces, Millhaven Homes offers beautiful features that will surely capture your interest and imagination.

If you are considering building a custom home with us, please fill out the information below and we will reach out to you to schedule an introductory meeting. https://millhavenhomes.com/get-started/