Dramatic as they seemed at the time, the upheavals wrought by Milken were only part of a much larger revolution. For today’s changes in the control and channeling of capital—still one of the changes in the entire economy. In Morgan’s time, and throughout the heyday of Wall Street power, the mass production of millions of identical products was symbolic of “modern times.” Today, we are standing the principle of mass production on its head. Computer-driven technologies are making it possible to turn out small runs of increasingly customized goods aimed at niche markers. Smart companies are moving from the production of long runs of increasingly customized goods aimed at niche markets. Smart companies are moving from the production of long runs of commodity products to short runs of “higher value products” like specialty steels and chemicals. Meanwhile, constant innovation shortens product life cycles. We find precisely parallel changes in the financial service industry, which is also diversifying product lines and shortening product life cycles. It, too, is spewing out a stream of niche products—new types of securities, mortgages, insurance policies, credit instruments, mutual funds, and endless permutations and combinations of these. Power over capital flows toward endless permutations and combinations of these. Power over capital flows toward firms capable of customization and constant innovation. In the new Third Wave economy, a car or a computer may be built in four countries and assembled in a fifth. Markets, too, expand beyond national boundaries. In the current jargon, business is becoming global. Once more, in direct parallel, we fund the financial services—banking, insurance, securities—all racing to “globalize” in order to serve their corporate clients. #RandolphHarris 1 of 20

The Third Wave economy operates at super-high speeds. To keep pace, financial firms are pouring billions into new technologies. New computers and communications networks not only make possible the variation and customization of existing products, and the invention of new ones, but also drive transaction speeds toward instantaneity. As new-style factories shift from “batch processing” to round-the-clock or “continuous flow” operations, finance follows suit, and shifts from “banker’s hours” to twenty-four-hour services. Financial centers crop up in multiple time zones. Stocks, bonds, commodities, and currencies trade nonstop. Electronic networks make it possible to assemble and disassemble billions in what seems like nanoseconds. Speed itself—the ability to keep pace or stay ahead—affects the distribution of profit and power. A good example is the shrinkage of the “float” once enjoyed by banks. “Float” is the money in customers’ accounts on which the bank can earn interest while customer checks are waiting to clear. As computers accelerate the clearing process, banks gain less advantage from these funds and are forced to find alternative sources of revenue—which leads them into frontal competition with other sectors of the financial industry. As capital markets expand and interlink, from Hong Kong and Tokyo to Toronto and Paris, crossing time zones, money runs faster. Velocity and volatility both rise, and financial power in society shifts from hand to hand faster and faster speeds. Take together, all these changes add up to the deepest restructure of the World finance since the early days of the industrial era. They reflect the rise of new system of wealth creation, and even the most powerful firms, once controlling vast flows of capital, are tossed about like matchsticks in a gale. #RandolphHarris 2 of 20

In 1985, America’s largest investment banker, Salomon Brothers, committed itself to build an impressive $455 million headquarters on Manhattan’s Columbus Circle. By spring of 1987 Salomon became the target of a possible takeover; in October it had to shut down the municipal bond business in had dominated for twenty years; its commercial paper department went, too; 800 of its 6,500 employees were laid off; the October 1987 stock market crash slammed into the firm, and by December it was ignominiously forced to backout of the big headquarters deal at a cost of $51 million. As profits plummeted and its own stock price fell, internal schisms rent the firm apart. One faction favored sticking to its traditional role as a capital supplier to the Blue Chips. Another sought to enter the high-yield or junk bond business that Milken had pioneered and reach out to second-tier firms. Defections and chaos followed. “The World changed in some fundamental ways,” rued its chairman, John Gutfreund, “and most of us were not on top of it. We were dragged into the modern World.” The “modern World,” however, is a volatile, hostile place of the old dragons. Not only individuals and companies, but whole sectors of the financial industry totter. The collapse of more than five hundred savings-and-loans banks in the United States of America, requiring the government to pump hundreds of billions into an emergency rescue plan, reflects the rising instability. Government regulatory agencies designed for a simpler, slower smokestack World proved unable to anticipate and avert the looming disaster, as hundreds of these “thrift institutions,” caught off guard and crushed by rapidly shifting interest rates, went down in a welter of corruption and stupidity. #RandolphHarris 3 of 20

As the global economy grows, the financial marketplace itself becomes so vast that it dwarfs any single institution, company, or individual—even a Milken. Tremendous currents rip through the system causing eruptions and perturbations on a global scale. From the dawn of the industrial era, money power was centered in Europe. By the end of World War II, it had shifted decisively to North America, and more specifically to the southern tip of Manhattan Island. U.S. economic dominance went unchallenged for nearly three decades. From then on, money—and the power that flows from it—has been zigzagging unsteadily across the planet like a pachinko Ball gone mad. In the mid-seventies, seemingly overnight, the OPEC cartel sucked billions out of Europe, North America (and the rest of the World), and sent them zigging into the Middle East. Immediately, these petrodollars were zagged into bank accounts in New York or Zurich, zigged out once more in the form of gigantic loans to Argentina, Mexico, or Brazil, shot right back to U.S. and Swiss banks. As the value of the dollar feel and trade patterns shifted, capital zagged again to Tokyo, and zigged back into real estate, government bonds, and other holdings in the United States of America—all at speeds that stagger the experts struggling to understand what is happening. With each such lurch of capital comes a corresponding redistribution of power at the global and local levels. As oil money fire-hosed into the Middle East, Arab nations began to wield a huge cudgel in international politics. Israel found herself increasingly isolated in the U.N. African countries, needing oil and eager for foreign aid from the Arabian people, broke off diplomatic relations with Jerusalem. #RandolphHarris 4 of 20

Petrodollars began to influence the media in various parts of the World. And the lobbies of hotels in Riyadh, Abu Dhabi, and Kuwait were jammed with attache-case-carrying supplicants—salesmen, bankers, executives, and wheeler-dealers from around the World, pleading ignominiously with this or that spurious relative of a royal family for contacts and contracts. However, by the early 1980s, as OPEC unity fell apart and oil prices collapsed, the frenzy waned, and so did Arab political power. Today the horde of supplicants, often representing the largest banks and corporations in the World, mill about the lobbies of hotels like the Okura or the Imperial in Tokyo. The growing volatility of the World capital market, dramatized by such huge swings and punctuated by stock market crashes and recoveries, as in the “Two Octobers”—October 1987 and October 1989—are a sign that the old system is increasingly going out of control. Old safety mechanisms, designed to maintain financial stability in a World of relatively closed national economies, are as obsolete as the rust-belt World they were designed to protect. Globalized production and marketing require capital to flow easily across national boundaries. This, in turn, demands the dismantling of old financial regulations and barriers erected by national removal of these barriers in Japan and in Europe has negative consequences as well. The result is a larger and larger pool of capital instantly available anywhere. However, if this makes the financial system more flexible and helps it overcome localized crises, it also raises the ante, escalating the risk of massive collapse. #RandolphHarris 5 of 20

Modern ships are built with watertight compartments so that a leak in one part of the hull cannot flood and sink the entire vessel. Liberalization of capital so that it can flow freely is the equivalent of eliminating these fail-safe compartments. Essential for the advance of the economy, it increases the danger that a serios collapse in one country will spread to others. It also threatens the power of one of the most important economic institutions of the industrial age: the central bank. Until a decade or so ago, a relative handful of central bankers and government officials could decisively affect the price of everything from Danish hams to Datsun cars by manipulating interest rates and intervening in foreign currency markets. Today this is becoming harder for them to do. Witness the explosive growth of the “forex,” or foreign exchange, markets and the electronic networks that facilitate them. Only a few years ago the Bank of Japan could influence the yen-dollar ratio by buying or selling 16 billions’ worth of dollars. Today such sums are laughable. An estimated 200 billion dollars’ worth of currencies are traded every day in London, New York, and Tokyo alone—more than a trillion a week. (Of this, no more than 10 percent is associated with World trade; the remaining 90 percent is speculation.) Against this background the role of individual central banks, and even of the major ones acting in concert, is limited at best. Because power is rapidly shifting out of the hands of central bankers and the governments they nominally represent, we hear urgent calls for new, more centralized regulation at supra-national level. These are attempts to control a post-smokestack financial system by using essentially the same tools used during the smokestack age—merely raised to a higher power. #RandolphHarris 6 of 20

In Europe some political leaders call for the elimination of national currencies and the creation of a single all-European central bank. France’s former finance minister Edouard Ballladour and West Germany’s foreign minister Hans Dietrich Genscher are joined by many French, Belgian, and Italian officials in pushing for this higher level of centralization. Though still some time off in the future, says economist Liane Launhardt of Commerzbank A.G. in Frankfurt: “We will eventually have to have a European central bank.” Against this supra-nationalism, Prime Minister Margaret Thatcher of Britain has waged a rear-guard action in defense of national sovereignty. However, even at the World level we begin to see increasingly attempts by the G-7, the group of seven largest industrial economies, to synchronize and coordinate their policies with respects to currencies, interest rates, and other variables. And academics and some financial experts argue for a “World central bank.” If the globalizers win, it will mean further weakening of the power of existing central banks—the key regulators of capital in the noncommunist World since the dawn of the smokestack age. The decades to come will therefore see a titanic power struggle between the globalizers and the nationalists over the nature of new regulator institutions in the World capital markets. This struggle reflects the collision between a moribund industrial order and the new global system of wealth creation that is replacing it. Ironically, however, these proposals to centralize control of global finance at a higher level run counter to developments at the actual level of economic production and distribution, both of which are becoming more dispersed, diverse, and decentralized. This suggests that the outcome of this historic power struggle may satisfy neither nationalists nor globalists. History, full of surprises, could force us to reframe the issues in novel ways and to invent wholly new institutions. #RandolphHarris 7 of 20

One thing seems clear. When the battle to reshape global finance reaches its climax in the decades ahead, many of the greatest “powers that be” will be overthrown. Yet even these upheavals in the distribution of World money-power reveals less than the whole story. They will be dwarfed in history by a revolution in the nature of wealth itself. For something odd, almost eerie, is happening to money itself—and all the power that flows from it. So many industrial-age institutions are racing toward implosion. Leaders who attempt to redesign old institutions face denial, stubborn resistance and conflict. Innovators who seek to create new institutions or organizations face skepticism. Both need guts, political skill, tenacity, a sense of timing and commitment. They need allies. Externa crisis—and even internal recognition of it—is not enough to bring about transformation in the absence of a persuasive, plausible, nonutopian vision of an alternative. And it is precisely here that social imagination is called for. Fortunately, there are tested tools that can help unleash it. One of these is the addition or subtraction of functions. For example, the university was originally a place to teach students. In the nineteenth century, the University of Berlin added research to its core functions and became a model for other universities around the World. In the twentieth century, innovators did the reverse, subtracting students from the model of a research university, leaving only the research. The result was a new type of institution called a think tank. Recently, a wave of adding and subtracting functions has swept through American industry under the rubric of outsourcing and insourcing. A corporate transformation also occurs when existent functions are either radically expanded or reduced. Big-enough changes in scale can add up to qualitative transformation. #RandolphHarris 8 of 20

In a World in which borders have become more porous, the distinction between foreign and domestic affairs has broken down. Should each country continue to have a foreign ministry? In universities, should neatly bounded academic disciplines be permanent? Of should disciplinary departments be replaced by temporary, problem-oriented teams comprising students and professors with diverse specialties? In all sectors of society—private, public, and civil—we will need completely new models of organization—strange combinations of networks within bureaucracies, bureaucracies within networks, checkerboard organizations, organizations flexible enough to double or halve their capacity overnight, organizations that survive by forming temporary “coalitions of the willing” to accomplish specified goals. Preventing systemic institutional implosion will require transforming not just big corporations and governmental departments but every level of the economy and society, from small business to churches, local unions and local NGOs. On a smaller, slower scale this happened before, when the industrial revolution was still young and needed new, post-agrarian institutions, from department stores and police forces to central banks and think tanks. Innovators arose from the most unexpected places and created them against far greater resistance and odds than those posed in today’s societies transitioning beyond industrialism. And it is here that the United States of America is perhaps the strongest. It has fewer lengthy traditions to protect. It has ethnic and cultural diasporas that bring ideas to America from all over the World. Its people are among the most entrepreneurial in the World—and not just in business. #RandolphHarris 9 of 20

It has intellectual entrepreneurs, activist entrepreneurs, online entrepreneurs, religious entrepreneurs, academic entrepreneurs. And, unlike societies that suppress individual entrepreneurialism, it preaches a gospel of change that celebrates it. However, America is not alone in innovational resources. Never in history have there existed more educated people committed to making change. Never have there been so many different kinds of institutions, or more powerful tools for matching, mixing, simulating, designing and testing new institutional models. Fortunately, we are beginning to see a new “meta-intuition” appear—a handful of laboratories for social invention and entrepreneurship—mainly focused on the civil-society sector, which is bubbling with energy and imagination. Some universities now teach courses in social invention. Some foundations offer modest awards for the best ideas. The U.S. Patent Office has approved patents for new business models. However, should not there be an imaginative new form of patent for equally creative social models? Innovation will either be sparked by topside leadership ready to transform existing institutions or it will explode from the bottom, as more and more industrial-age institutions collapse and systemic implosion nears. Advanced economies are honeycombed with millions of social inventors, innovators, organizational risk-takers, dreamers and practical men and women, better educated, with access to more knowledge from everywhere, armed with the most powerful knowledge tools known to the human race and bursting for the chance to invent a better tomorrow. They are all over the World, ready to remake it. #RandolphHarris 10 of 20

As for the United States of America, it is especially rich with innovative, ever-inventive, try-it-out, go-for-it people eager to test new idea and new models. Even the Sepulveda Solution—the crazy, wonderful juxtaposition of a car wash offering the latest best sellers, how-to books and the works of Cervantes and Garcia Marquez; Dante, Darwin and Du Bois; Whiteman and Wollstonecraft; Aristotle and Plato; Machiavelli and Rousseau; John Locke; and Thomas Paine’s ever-inspiring Rights of Man. A car wash, even with a bookstore, will not change America, let alone the World. However, thousands, indeed millions, of creative adaptations to the emerging markets, culture and conditions of the knowledge economy will. If a car wash can also be a bookstore, the range of options for preventing an institutional implosion may be limited only by our social imagination. The time has come to free it. With the rise of Technopoly, one of those thought-Worlds disappears. Technopoly eliminates alternatives to itself in precisely the way Aldous Huxley outlined in Brave New World. It does not make them illegal. It does not make them immoral. It does not even make them unpopular. It makes them invisible and therefore irrelevant. And it does so by redefining what we mean by religion, by art, by family, by politics, by history, by truth, by privacy, by intelligence, so that our definitions fit its new requirements. Technopoly, in other words, is totalitarian technocracy. The United Sates of America is the only culture to have a Technopoly. It is a young Technopoly, and we can assume that it wishes not merely to have been the first but to remain the most highly developed. Therefore, it watches with a careful eye Japan and several European nations that are striving to become Technopolies as well. #RandolphHarris 11 of 20

To give a date to the beginnings of Technopoly in America is an exercise in arbitrariness. It is somewhat like trying to say, precisely, when a coin you have flipped in the air begins its descent. You cannot see the exact moment it stops rising; you know only that it has and is going the other way. Huxley himself identified the emergence of Henry Ford’s empire as the decisive moment in the shift from technocracy to Technopoly, which is why in his brave new World time is reckoned as BF (Before Ford) and AF (After Ford). Because of its drama, we are tempted to cite, as a decisive moment, the famous Scopes “monkey” trial held in Dayton, Tennessee, in the summer of 1925. There, as with Galileo’s heresy trial three centuries earlier, two opposing World-views faced each other, toe to toe, in unconcealed conflict. And, as in Galileo’s trial, the dispute focused not only on the content of “truth” but also on the appropriate process by which “truth” was to be determined. Scopes’ defenders brought forward (or, more accurately, tried to bring forward) all the assumptions and methodological ingenuity of modern science to demonstrate that religious belief can play no role in discovering and understanding the origins of life. William Jennings Bryan and his followers fought passionately to maintain the validity of a belief system that placed the question of origins in the words of their god. In the process, they made themselves appear ridiculous in the eyes of the World. Almost seventy years later, it is not inappropriate to say a word in their behalf: These “fundamentalists” were neither ignorant of nor indifferent to the benefits of science and technology. They had automobiles and electricity and machine-made clothing. #RandolphHarris 12 of 20

They used telegraphy and radio, and among their number were men who could fairly be called reputable scientists. They were eager to share in the largesse of the America technocracy, which is to say they were neither Luddites nor primitives. What wounded them was the assault that science made on the ancient story from which their sense of moral order sprang. They lost, and lost badly. To say, as Bryan did, that he was more interested in the Rock of Ages than the age of rocks was clever and amusing but woefully inadequare. The battle settled the issue, once and for all: in defining truth, the great narrative of inductive science takes precedence over the great narrative of Genesis, and those who do not agree must remain in an intellectual backwater. Studies of nanotechnology are today in the exploratory engineering phase, and just beginning to move into engineering development. The basic idea of exploratory engineering is simple: combine engineering principles with known scientific facts to form a picture of future technological possibilities. Exploratory engineering looks at future possibilities to help guide our attention in the present. Science—especially molecular science—has moved fast in recent decades. There is no need to wait for more scientific breakthroughs in order to make engineering breakthroughs in nanotechnology. Exploratory engineering has an outer box which represents the set of all the technologies permitted by laws of nature, whether they exist or not, whether they have been imagined or not. Within this set are those technologies that are manufacturable with today’s technology, and those that are understandable with today’s science. #RandolphHarris 13 of 20

Textbooks teach what is understandable (hence teachable) and manufacturable (hence immediately practical). Practical engineers achieve many success by cut-and-try methods and put them into production. Exploratory engineers study what will become practical as manufacturing abilities expand to embrace more of the possible. Each of these types of exploratory engineering relates most familiar kinds taught in school: this “textbook engineering” covers technologies that can be both understood (so they can be taught) and manufactured (so they can be used). Bridge-building and gearbox design fall in this category. Other technologies, however, can be manufacture but are not understood—any engineer can give examples of things that work when similar things do not, and for no obvious reason. However, as long as they do work, and work consistently, they can be used with confidence. This is the World of “cut-and-try engineering,” so important to modern industry. Bearing lubrication, adhesives, and many manufacturing technologies advance by cut-and-try methods. Exploratory engineering covers technologies that can be understood but not manufactured—yet. Technologies in this category are also familiar to engineers, although normally they design such things only for fun. So much is known about mechanics, thermodynamics, electronics, and so forth that engineers can often calculate what something will do, just from a description of it. Yet there is no reason why everything that can be correctly described must be manufacturable—the constraints are different. Exploratory engineering is as simple as textbook engineering, but neither military planners nor corporate executive see much profit in it, so it has not received much attention. #RandolphHarris 14 of 20

The concepts of molecular manufacturing and molecular nanotechnology are straightforward results of exploratory-engineering research applied to molecular systems. As we observed above, if anyone had bothered, the basic ideas could have been worked out sixty years ago. However, now, with the threshold of nanotechnology approaching, attention is beginning to focus on where the next steps lead. If technology keeps advancing, and competition practically guarantees that advanced will continue, nanotechnology seems to be where the World is headed. It will open both a huge range of opportunities for benefit and a huge range of opportunities for misuse. We will paint scenarios to give a sense of the prospects and possibilities, but we do not offer predictions of what will happen. Actual human choices and blunders will depend on a range of factors and alternatives beyond what we can hope to anticipate. Television is another interesting form of technology. The attempt to push the information through television foes flat. It does not work. The viewer is left to evaluate aspects of the experience that television can capture, and these reduce to objective facts like the arguments among opposing viewpoints as to the best use of this area. People need homes. The developer has a right to profit. The tax base of the community is affected. Meanwhile, the ecologists speak of flyways and breeding grounds, endangered plants and nearly extinct creatures. A whole world of sensory information has been abandoned, and yet it is in this World that real understanding of marshes exists. And without the understanding who can care about the marsh? Taxes become more important. Birds can be seen elsewhere. Images of mud and reeds do not inspire the mind, especially compared with the hard facts of our World. People need jobs building hoses. Nobody ever “uses” swamps anyway. #RandolphHarris 15 of 20

It is possible that viewers of that program had a greater feeling for swamps when the swamps resided totally in their imaginations, where, at least, they had the richness that fantasy can creature. On television, the fantasy is destroyed and the perspective is flattened. What was true for this news report is true for all television programs that concern nature. Seeing the forests of Borneo on television makes one believe that one knows something of these forests. What one knows, however, is what television is capable of delivering, a minute portion of what Borneo forests are. It cannot make you care very much about them. When Georgia-Pacific proceeds to cut down hundreds of thousands of acres of Borneo forests, at it has so many others in the Pacific Basin, one remains unmoved. The wood is needed for homes. The objective data dominate when only objective data can be communicated. Meanwhile, sitting in our dark rooms ingesting images of Borneo forests, we lose feeling even for the forests near our homes. While we watch Borneo forests, we are not experiencing neighbourhood forests, local wilderness or even local parks. As forests experience reduces to television forest, out caring about forests, any forests, goes into dormancy for lack of direct experience. And so the lumber company succeeds in cutting down the Borneo forest, and then, near to home, it also succeeds in building a new tract of condominiums where a local park had been. In my opinion, the more the natural environment is conveyed on TV, the less people will understand about it or care about it, and the more likely its destruction becomes. Ecologists would be wise to abandon all attempts to put nature on television. #RandolphHarris 16 of 20

Programs concerned with the arts, programs concerned with many religions and all programs concerned with non-Western cultures are similarly distorted by television’s inability to convey their sensual aspects. Theater music, dance, if they are to be fully understood and appreciated, require exquisitely fine visual and aural reproduction as well as exquisitely tuned sense reception in the viewer. The experience of them on television is only the barest approximation of the direct experience of the performance. The information loss is enormous, and it is the most critical and subtle the information that is lost. Some people argue that television delivers a new World of art to people in, say, Omaha, who might otherwise never see the Stuttgart Ballet or the New York Philharmonic. They say this stimulates Ballet or the New York Philharmonic. They say this stimulates interest in the arts. I find this very unlikely. Information received with only two senses, especially in the limited range of television, and considering the other dulling aspects of the medium, is simply not the same at the receiving end as it would have been in the theater or concert hall. On television the depths are flattened, the spaces edited, the movements distorted and fuzzed-up, the music thinned and the scale reduced. This would have to affect the level of understanding and limit the quality of the experience. The human senses cannot experience what is not there. If the television delivers a drastically reduced version of an art experience, then this is what the senses must deal with, and if one has never directly experienced the real thing, how is one to know that the reality is richer than the television version? #RandolphHarris 17 of 20

Reading Moby Dick as a comic book does not inspire one to read Moby Dick in the original. Quite the opposite. And so seeing the Stuttgart Ballet performing on television leaves one with such a reduced notion of ballet as to reduce the appeal of the ballet itself. The result is likely to be boredom and switched channels. To say that such a program stimulates new interest in arts is to behave. And so it goes in all areas. The religions of the World, from Tibetan Buddhism to many forms of Catholicism, are deeply rooted in the rich interplay of the human mind and senses. On television they must be understood through fixed cerebral channels, leaving description, but no feeling. The same can be said for must cultures of the World still immersed in the sensory relationships between human and environment. There is no way to effectively convey African cultures, as was mentioned, through images disconnected from the other senses, and certainly not through logical analysis. More often than not these cultures and others are sensually or mystically based and can be deeply understood only in those terms. Unfortunately, television makes the effort to explain them anyway, just as it claims to convey nature, the arts, the news and the details of human feeling. Human beings who view these attempts are led to believe that these fuzzy little pellets of information about our rich, subtle, complex and varied World constitute something close to reality. What they really do is make the World as fuzzy, coarse, and turned-off as the medium itself. If flesh feels inherently good, the more flesh must feel that much better! This simple idea emerges out of a kind of folk-wisdom that stretches back to the Paleolithic era. A similar cultural predisposition toward the opposite extreme of thinness certainly pervades post-industrial culture. The two extremes are inextricably linked by a core fascination with the power of food…a fixation which ranges back past the era of human evolution to the roots of mentality in the higher primates, in which eating becomes the key drive of pleasures of the flesh. #RandolphHarris 18 of 20

The force-feeder control the victim bound by the magnitude of their own flesh, the surgeon or anorectic controls the subject’s bodily integrity. The consumptive fetish, as we might call the two combined back into their root, is the primordial source of all sado-masochistic behavioural patterns, since food and flesh are the most primary instruments of control, of life and death themselves. It is assumed that the chronological story of the World is in the primeval state and evolutionarily stable. However, cooperation based on reciprocity can gain a foothold through two different mechanisms. First, there can be kinship between mutant strategies, giving the genes of the mutants some stake in each other’s own success, thereby altering the payoff of the interaction when viewed from the perspective of the gene rather than the individual. A second mechanism to overcome total defection is for the mutant strategies to arrive in a cluster so that they provide a nontrivial proportion of the interactions each has. And if the probability that interaction between two individuals will continue is great enough, then TIT FOR TAT is itself evolutionarily stable. Moreover, its stability is especially secure because it can resist the intrusion of whole clusters of mutant strategies. Thus cooperation based on reciprocity can get started in a predominately noncooperative World, can thrive in a variegated environment, and can defend itself once fully established. A variety of specific biological applications of this approach follows from two of the requirements for the evolution of cooperation. The basic idea is that an individual must not be able to get away with defecting without the other individuals being able to retaliate effectively. #RandolphHarris 19 of 20

The response requires that the defecting individual not be lost in a sea of anonymous others. Higher organisms avoid this problem by their well-developed ability to recognize many different individuals of their species, but lower organism must rely on mechanisms that drastically limit the number of different individuals or colonies with which they can interact effectively. The other important requirement to make retaliation effective is that the probability of the same two individual meeting again must be high. When an organism is not able to recognize the individual with which it had a prior interaction, a substitute mechanism is to make sure that all of its interactions are with the same player. This can be done by maintaining continuous contact with the others. This method is applied in most mutualisms, situations of close association of mutual benefit between members of different species. Ideology today, in popular speech, is, in the first place, generally understood to be a good and necessary thing—unless it is bourgeois ideology. The evolution of the term was made possible by the abandonment, encouraged by Nietzsche, of the distinction between true and false in political and moral matters. Men and societies need myths, not science, by which to live. In short, ideology became identical to values, and that is why it belongs on the honour roll of terms by which we live. If we examine Weber’s, of course, meant that all societies or communities of human beings require such violent domination—as the only way order emerges from chaos in a World with no ordering force in it other than man’s creative spirituality—while Marxists still vaguely hope for a World where there are values without domination. This is all that remains of their Marxism, and they can and do fellow-travel with Nietzscheans a goodly bout de chemin. One sees their plight in the fact that ideology no longer has its old partner, science, in their thought, but stands in lonely grandeur. #RandolphHarris 20 of 20

Cresleigh Homes

Ready to fall in love? A Cresleigh Home is ideal for those looking to take advantage of perfectly balanced spaces, floor plans that are perfect for entertaining so the chef always feels included in the events at all times, and a kitchen, dining, and living room arraged to look out into the backyard so one can keep an eye on their children.

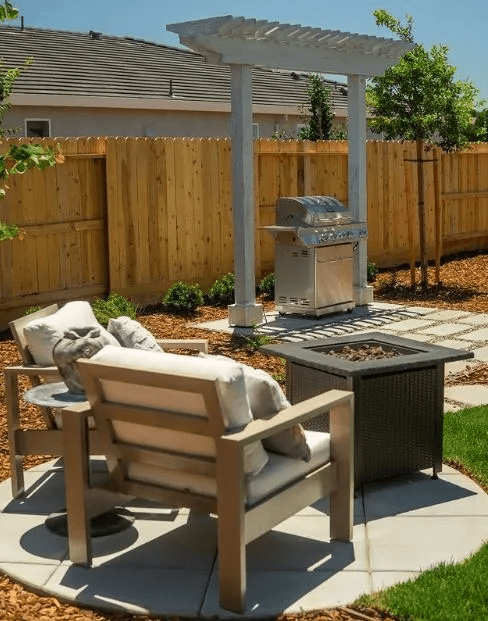

We certainly get that feeling when we sit fireside 🔥 in the backyard of our Residence 1 home at #CresleighMeadows! Luxury doesn’t have to be fussy- it just has to be effortlessly comfy! 🌟

Your will enjoy the outdoor living, and at nearly 2,000 square feet, the house is spacious allow you to continue growing into your home for years to come.

#PlumasRanch

#CresleighHomes